Originally published by NAIOP Research and Publication, Spring 2025

Originally published by NAIOP Research and Publication, Spring 2025

North Carolina is the fourth highest-ranking state in the U.S. for overall contributions of commercial real estate to state GDP, with $34.2 billion, $15.2 billion in direct spending, $10.5 billion in personal earnings, and 185,936 jobs supported in 2024 (the most recent data available).

The data is from “Economic Impacts of Commercial Real Estate, 2025 U.S. Edition,” published annually by the NAIOP Research Foundation.

The NAIOP Research Foundation has published the annual Economic Impacts of Commercial Real Estate, 2025 U.S. Edition, research study. The combined economic contributions of new commercial building development and the operations of existing commercial buildings in 2024 resulted in direct expenditures of $898.5 billion and the following impacts on the U.S. economy:

Other highlights from the report:

Originally published on June 8, 2023, by Brielle Scott for NAIOP.

“Please raise your hand if your tenants have encountered any difficulties obtaining or retaining the workforce they need,” Anne Strauss-Wieder, Director, Freight Planning, North Jersey Transportation Planning Authority, asked the audience at NAIOP’s I.CON East: The Industrial Conference.

Originally published on April 3, 2023, by Kathryn Hamilton, CAE for NAIOP E-Newsletter.

“There’s a really exciting trend emerging in hiring and compensation that’s going to accelerate throughout 2023,” opened Chris Lee, CEO of CEL & Associates, during a recent NAIOP webinar. “It’s the blending together of the quantitative – the numbers, compensation and bonuses – and the qualitative – workplace environment and benefits.”

Originally published on January 31, 2023, by NAIOP E-Newsletter.

NAIOP is your forward-thinking partner committed to working alongside our members to build your knowledge, advance your career and protect your business.

Originally published on January 26, 2023 by Kathryn Hamilton for NAIOP E-Newsletter.

The impact of new commercial real estate development in the U.S. continues to grow, according to the annual Economic Impacts of Commercial Real Estate research study conducted by the NAIOP Research Foundation.

Originally published on January 19, 2023 for NAIOP E-Newsletter.

ESG is emerging as a hot topic for businesses and commercial real estate development in particular. To stay ahead, developers can embrace standards to set their projects up for success. Learn how smart building technologies, tax and state incentive programs, and setting measurable goals as companies establish their ESG practices can support this evolving initiative.

Originally published in NAIOP Research Foundation's Fourth Quarter 2022 Report.

The NAIOP Research Foundation has published the NAIOP Office Space Demand Forecast for Q4 2022.

Originally published in October 2022, by Clifford A. Lipscomb, Ph.D., MRICS for NAIOP.

Industries are rapidly evolving as business processes grow more interconnected and automated. Data and analytics play an important role in information technologies and their interaction with the physical world, including emerging fields such as artificial intelligence, the Internet of Things (IoT), and virtual and augmented reality. Although commercial real estate (CRE) has been slower than other industries to adopt data analytics, some firms have identified several ways that data analytics can support land and building development and contribute to better project outcomes.

Originally published on November 15, 2022, by NAIOP.

NAIOP’s valuable 60-page e-book, “Rules of Thumb for Distribution/Warehouse Facilities Design, Second Edition,” allows you to gain a step up in today’s competitive marketplace. The e-book includes detailed instructions and diagrams on everything from site planning to floor slabs. Members save 50% off the list price!

Is your 2023 salary and bonus package competitive? Find out with the 2022 NAIOP/CEL Commercial Real Estate Compensation and Benefits Reports. These valuable reports (either Office/Industrial-Retail or Office/Industrial-Retail-Residential) enable commercial real estate businesses to stay current on salaries, bonuses, and benefits for CRE professionals from executive to entry-level positions.

The report includes:

Originally published on October 18, 2022, by NAIOP.

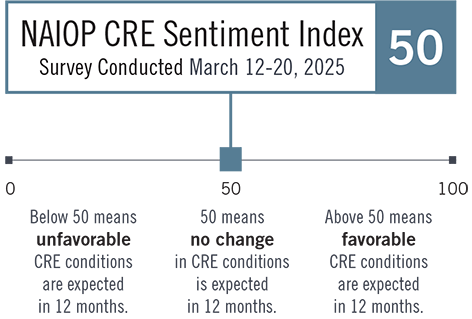

The NAIOP CRE Sentiment Index for September 2022 is 47, down from April’s reading of 53. It is at its lowest level since September 2020. This reading suggests that respondents expect unfavorable conditions for commercial real estate over the next 12 months.

Originally published in the Fall 2022 NAIOP Development Magazine by Ron Derven.

Since its founding in Dallas in 1991, Granite Properties has understood the impact of real estate developments on people and communities. That’s why it creates spaces and relationships where people can flourish while supporting local communities.

Two and a half years after the pandemic began, the short-term future for the office sector remains uncertain, with record vacancy rates adding to the industry’s woes, according to a recent office report from CommericalEdge. And as hybrid and work-from-home business models continue to take hold — and rising inflation rates further deter workers from returning to traditional office settings — the sector’s long-term prospects are also murky.

The average full-service equivalent listing rate in the top 50 U.S. office markets was $37.58 per square foot in June — up two cents from the previous month, but down 2.6% from the previous year.

The SMP’s goal is to shape the mobility future for the City of Charlotte and expand on the “Safe and Equitable Mobility” goal of the Charlotte Future 2040 Comprehensive Plan (2040 Plan). The SMP dives deeper into the mobility policies of 2040 Plan to achieve a safe, connected, equitable, sustainable, prosperous, and innovative mobility vision for Charlotte. To learn more, follow this link to the Strategic Mobility Plan homepage.

SMP Virtual Engagement Sessions will be live on Thursday, May 26 (6 p.m.) and Tuesday, May 31 (noon). Meeting links will be available by visiting charlottenc.gov/smp.

originally posted by REBIC for Two for Tuesday with permission to repost

For more information on the new advisory boards, please visit: https://charlottenc.gov/CityClerk/Pages/BoardsandCommissions.aspx

originally published by REBIC with permission to repost through NAIOP Charlotte