Posted on October 29, 2019

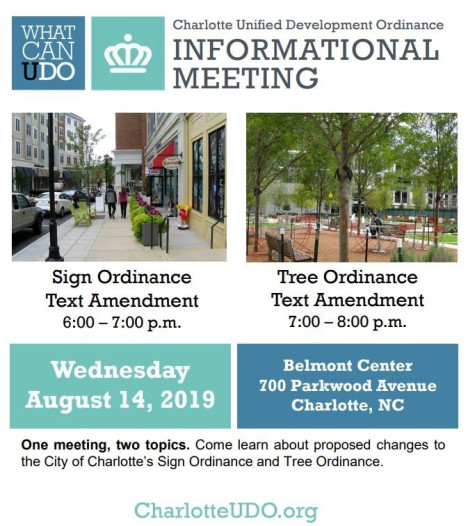

On October 21 Charlotte City Council voted to approve updates to the sign and tree ordinances. Most importantly, the updated tree ordinance allows for more flexibility for developers on urban sites in the City, which is less than 5% of Charlotte’s total developable land.