Read the full article here!

Buildings account for 39% of global greenhouse emissions — that could be an opportunity for investors

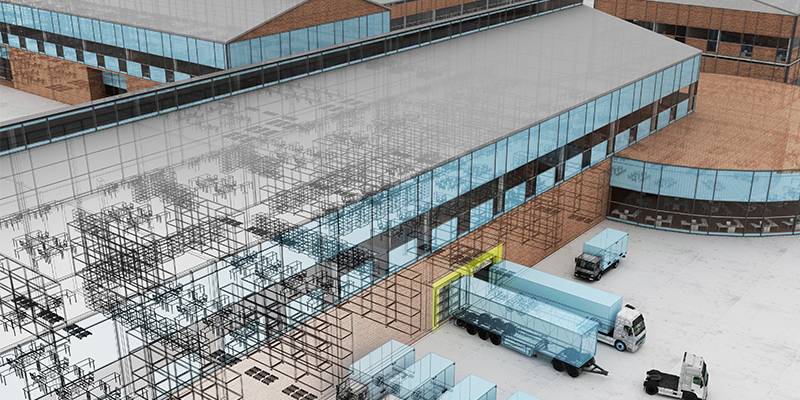

Investing in sustainable buildings could offer a real solution to reducing emissions in one of the world’s most polluting sectors, said Taronga Ventures, an investment firm focused on sustainable innovation and tech.

Buildings currently represent 39% of global greenhouse emissions, according to U.N. data. Almost one-third (28%) of the global total is the result of running buildings — referred to as operational emissions, while 11% comes from building materials and construction.

Read More

- Supply chain challenges

- Spikes in Rent and Demand

- Building Design and Location

- Predicting the Future

Read the full article here!

Originally published for NAIOP's Development Magazine Summer 2021 Issue by Trey Barrineau.

However, a lot of work remains despite tangible advances in recent years.

Women and minorities have made some progress in reaching the C-suite in commercial real estate investment management firms during the past few years, but the 2021 NAREIM Diversity & Inclusion Survey shows that there is still a lot of work to do.

Read More

Originally published on September 1, 2021, by Kathryn Hamilton for NAIOP Newsletter.

The term “supply chain” was coined on June 4, 1982, when the Financial Times published an article that used it as a replacement for “production and inventory management.” Now a permanent part of our lexicon, looking back at just how the supply chain has grown and changed over four decades is how a panel of industry leaders began their presentation at NAIOP’s I.CON West, held this week in Long Beach, California.

Read More

Originally published on September 1, 2021, by Marie Ruff for NAIOP News.

Commercial real estate professionals always seek to determine where markets stand now and what to expect for the future. That future is particularly uncertain today as we see the continued impacts of the COVID-19 pandemic.

Read More

Industrial Space Demand Remains Strong

Demand for industrial real estate continues to be strong as the long-term trend toward e-commerce (and away from in-store sales) continues with no end in sight. With nearly 100 million new square feet delivered nationally since the beginning of the year, 450 million square feet currently under construction and another 450 million planned, the demand for industrial real estate still outpaces supply.1

Because of this, authors Dr. Hany Guirguis and Dr. Michael Seiler forecast that the total net absorption in the second half of 2021 will be 162.6 million square feet with a quarterly average of 81.3 million square feet. In 2022, the projected net absorption is 334.6 million square feet with a quarterly average of 83.6 million square feet. An improvement in the outlook for the economy in 2021 and 2022 is behind the upward revision of the 2022 forecast. For example, the real GDP growth rate is now forecast to be 7% in 2021, above the previous forecast of 5% growth. As economic growth is projected to revert toward long-term growth rates in 2023, net absorption in the first half of the year is forecast to be 160.5 million square feet, for a quarterly average of 80.2 million square feet.

Download Report

Originally published on August 24, 2021, for NAIOP News.

Through his experience leading a turnaround as the former CEO of Prologis, Walt Rakowich realized leaders today must lean into timeless values and principles, but with a fresh perspective on the new and complex realities of our leadership climates. In a keynote address next week at I.CON West: The Industrial Conference, Rakowich will share advice on engaging your values and your organization with purpose and passion. Join the 700+ industrial real estate leaders planning to attend I.CON West next week in Long Beach.

Read More

Originally published on August 18, 2021, by Toby Burke for NAIOP.

The federal government has provided additional support for state and local governments in response to the COVID-19 pandemic. President Joe Biden signed the American Rescue Plan Act (ARP) into law on March 11, which established the Coronavirus State and Local Fiscal Recovery Funds. The new federal funds provide $350 billion to support state, local, territorial, and tribal governments in responding to the COVID-19 pandemic and spurring economic growth. These federal funds are a windfall for some governments that did not experience a fiscal shortfall, particularly at the state level.

Read More

#1) 2040 Comprehensive Plan - Next Steps with Councilmembers Renee' Johnson and Victoria Watlington

The first draft of the Unified Development Ordinance (UDO) is expected to be released to the public on or around October 4th. A recent presentation from Planning Staff to Charlotte’s Transportation, Planning, & Environment Committee contained the following:

Read More

Stairs on the Rise

Originally published by Shantala Weiss for NAIOP's Development Magazine.

Monumental stairs can inspire greater interaction, reduce energy costs, and improve employee health and fitness.

In the wake of COVID-19, workplaces are presented with a unique opportunity to shape corporate culture's future and use physical space to foster a sense of community and innovation that can’t be offered when working from home. Building elements that align with the goals of active, sustainable, and universal design have the potential to play a crucial role in post-pandemic commercial real estate.

Read More

Originally published by Rob Naso for NAIOP Development Magazine Summer 2021 Issue

A new framework for mitigating disease in the office focuses on air quality, changing behaviors and building occupant trust.

The COVID-19 pandemic has redefined the role that office landlords play in creating safe, healthy work environments. While most office workers packed up their laptops and headed home to ride out the pandemic, building owners and property managers had to pivot quickly to elevate safety measures for the essential workers who remained, in an environment with fast-changing public health guidelines. Now, they face the next stage of recovery — ensuring tenants feel comfortable returning to the workplace as vaccination rates increase.

Read More

Originally published by Hany Guirguis, Ph.D., Manhattan College and Michael J. Seiler, DBA, William & Mary in August 2021

Industrial Space Demand Remains Strong

Demand for industrial real estate continues to be strong as the long-term trend toward e-commerce (and away from in-store sales) continues with no end in sight. With nearly 100 million new square feet delivered nationally since the beginning of the year, 450 million square feet currently under construction, and another 450 million planned, the demand for industrial real estate still outpaces supply.1

Read More

Originally published by Philip Wilkinson and Teresa Bucco for NAIOP Development Magazine Summer 2021 issue.

A project in Pittsburgh demonstrates the potential of activating common areas in older retail destinations.

For nearly two decades, online shopping has seen steady growth in both traffic and sales, which has forced traditional retailers to think of new ways to draw people into brick-and-mortar stores. In more recent years, shifts toward experiential retail saw many retailers overhauling store designs to give shoppers more hyperlocal, boutique or high-end encounters while encouraging online buying and in-store pickup.

Read More

Originally published on July 29, 2021, by Sheheryar Hafeez for the NAIOP E-Newsletter.

Real estate investment trust (REIT) merger and acquisition activity has emerged from the pandemic in full force with some $75 billion in investment nationally from January through mid-July 2021. This robust activity is expected to continue throughout what could potentially be a record-breaking year. While all 11 Global Industry Classification Standard sectors are in positive territory for the year, real estate ranks second highest with a strong 27% performance, just slightly below energy.

Read More

Originally published by Scott Murdoch for the Summer 2021 Issue of NAIOP Development Magazine.

The pandemic forced the industry to adapt quickly to meet soaring demand.

While grocery e-commerce was growing prior to the pandemic, the sector saw staggering market penetration over the course of 2020 and beyond. Concerned about safely accessing food, consumers across all demographics turned to online grocery shopping as a convenient, safe option.

Read More

Originally published on July 27, 2021, by Ester Fung for the Wall Street Journal.

U.S. commercial real-estate sales this year have rebounded to pre-pandemic levels, fueled by historically low-interest rates and the belief of many investors that the worst of Covid-19 is over.

Read More

Originally published on July 21, 2021, for NAIOP E-Newsletter.

Owners and developers of commercial real estate recognize that obtaining local building permits is an essential and fundamental requirement for the development and improvement of their properties. The processes for obtaining these permits vary by municipality and state. These variations lead to uncertainties and delays in projects moving forward, which impacts the development project’s financing, cost and the retention of contractors, construction equipment and other materials.

Read More

As Building Material Prices Skyrocket, Project Managers Offer Strategies to Mitigate Risk

Originally published on July 23, 2021, by Roger McCarron for NAIOP E-Newsletter.

The COVID-19 pandemic, and the waves of lockdowns and business interruptions it prompted, affected global supply chains in virtually every industry — and construction is no exception. Due to widespread shortages of building materials, and pent-up demand from projects that were delayed or postponed during the pandemic, costs for materials including lumber, copper, steel, aluminum and vinyl skyrocketed. According to the National Association of Homebuilders, lumber prices spiked to a more than 300% year-over-year increase in May. While prices have since come down, they remain higher than historical averages and data suggest that demand for construction materials is approaching pre-pandemic levels.